As we end the year, we reflect back on what a great year 2022 has been for Forest Enterprises.

The expert and disciplined approach of our team, the strong relationships we have built in the industry, and our focus on delivering to clients, have united to overcome many challenges. These challenges were driven by supply chain disruptions, periods of low log prices, inflationary pressure on costs, and some brutal weather.

The achievements for Forest Enterprises this year have included adding another 25 of our managed investment forests to the 19 that are Forest Stewardship Council® (FSC® C168647) certified, and the registration of our latest new investment – Bideford Forest Investment. These are particularly pleasing in the 50th anniversary year of the establishment of Forest Enterprises.

However, our golden anniversary has been tinged with sadness because the very man who founded Forest Enterprises in 1972 passed away on 22 November. We stand on the shoulders of giants and Charles Wallis was a titan in the forestry investment industry. At Forest Enterprises we are proud to continue the legacy and high standards Charles established with his vision and energy. Our heartfelt sympathy are with Ann and her family.

Wishing you all a happy holiday season.

Bert Hughes

CEO & Forestry Director

22 December 2022

A tribute to Forest Enterprises’ founder, Charles Wallis

It is with great sadness that we share with you the news that Charles Wallis passed away last month, 50 years after founding Forest Enterprises.

He will be remembered for his wisdom, for always being the perfect gentlemen, and for always giving his time generously to help investors, colleagues, staff and business partners alike.

Charles will be remembered not only for his true grit but also as a gentleman with an engaging, caring personality and a desire to help people succeed.

We at Forest Enterprises are proud to continue his legacy by growing the business he had the vision to create and build.

A golden milestone: Forest Enterprises celebrates 50 years

-

the first company in New Zealand to introduce forestry as a public issue investment for direct ownership

-

first company in New Zealand to provide limited liability for investors via partnerships of qualifying companies

-

first company in New Zealand to provide the market with independent research on our forestry investment product

-

first public issue forestry investment company in New Zealand to start harvesting investor forests planted in the 1970s

-

first company in New Zealand to implement the limited partnership investment structure for forestry investment

-

first company in New Zealand to promote second rotation forestry investments under the new financial markets regime

-

first Managed Investment Schemes in New Zealand to hold Forest Steward Council® certification for responsible forest management (FSC® C168647)

Strong, early interest in Bideford Forest Investment

We are very pleased with the strong response we’ve had to our latest offer, the Bideford Forest Investment, now over 55% subscribed with four weeks of registration.

Bideford Forest combines the Pinedale and Tividale forests near Masterton which we originally established 30 years ago. This second rotation forest qualifies to earn income from the sale of carbon credits from 2030, and from timber harvest in 2047 and 2050. A mix of tree crop management regimes within the forest allows us to maximise returns to investors.

Minimum initial investment $10,078 for 200 shares, plus $3,099* in calls spread over just 5 years 2025-2029. No calls in the first two years.

Projected gross return $121,809*. Projected gross IRR 14%*

Download a copy of the Product Disclosure Statement here, or contact Nikki Coulmann or Sean Roberts for more information.

* All figures quotes per 200 shares, before tax, and adjusted for 2% p.a. inflation. Based on Forest Enterprises’ 36-month average log prices to 30 September 2022 and a price of $80 per carbon credit. Refer Product Disclosure Statement dated 25 November 2022 for cashflow projection and assumptions. Bideford Forest Investment is a managed investment scheme structured as a limited partnership, offered by Forest Enterprises Growth Limited, issued and managed by Forest Enterprises Limited (a related party).

FSC® certification achieved for Forest Enterprises investment forests

Chair John Sexton retires from Forest Enterprises Ltd board

Yogesh Mody appointed independent director

New regulatory standards for forestry impact Forest Enterprises

Forests in good shape after East Coast weather bombs

Global log market impacts local harvest production

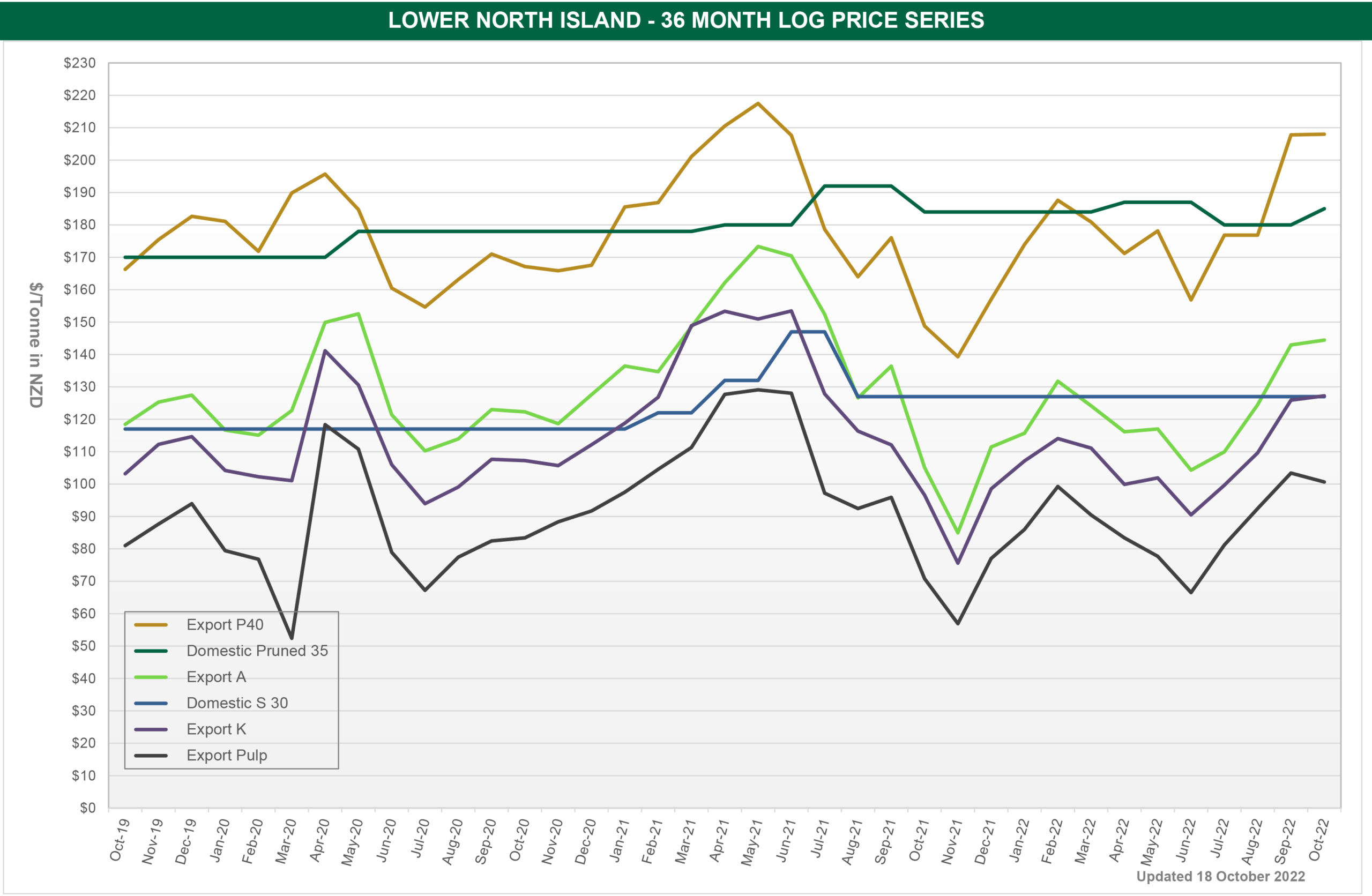

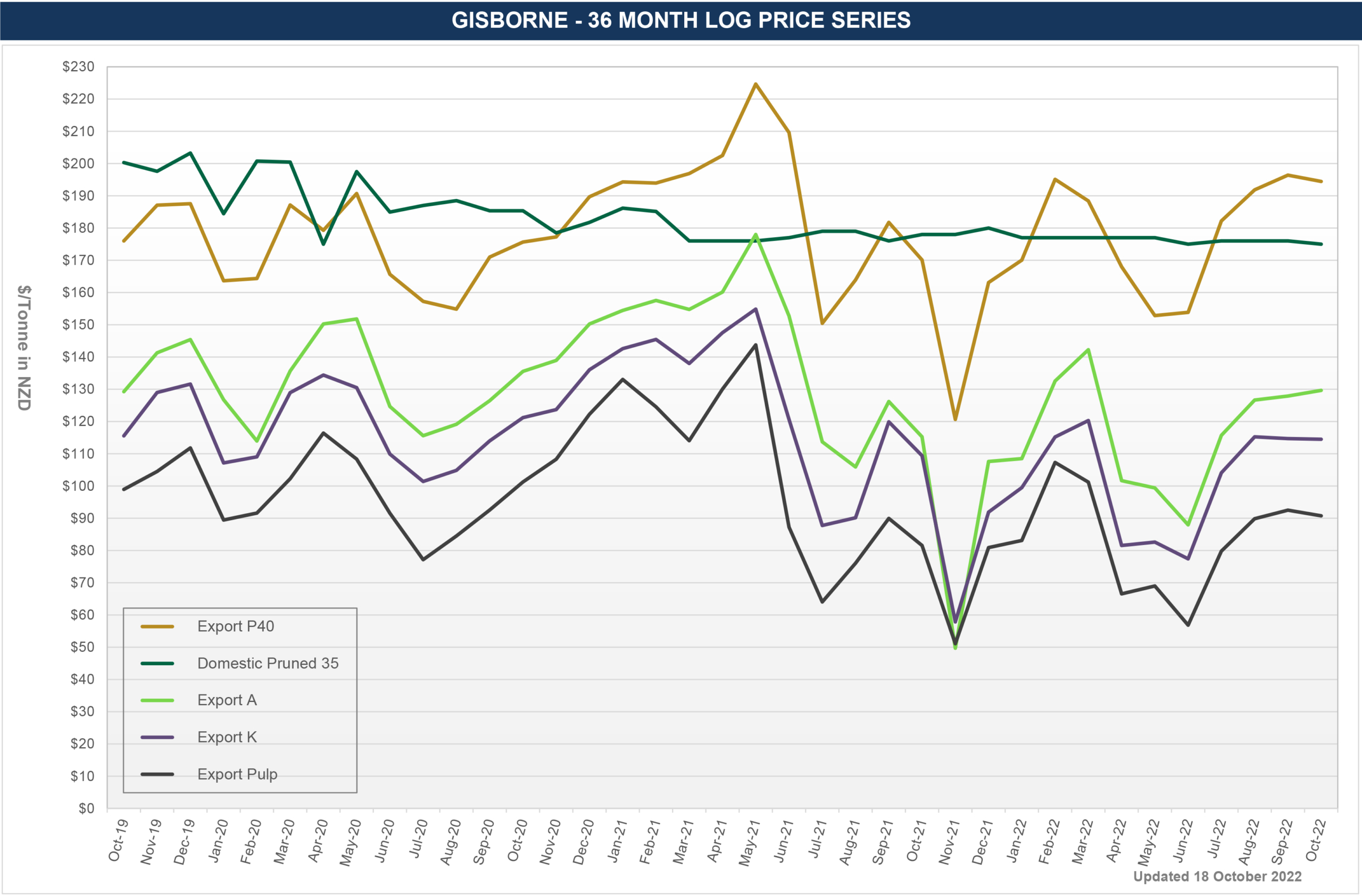

The world economy has been in turmoil from the unpredictability of Covid-19 and war. Log prices have been tumultuous this year as normal trade patterns and supply-demand have been disrupted.

Forest Enterprises’ harvesting operations are not immune.

Read the latest log market analysis Quarter ending September 2022 >>

Graeme Tindall celebrates 25 years at Forest Enterprises

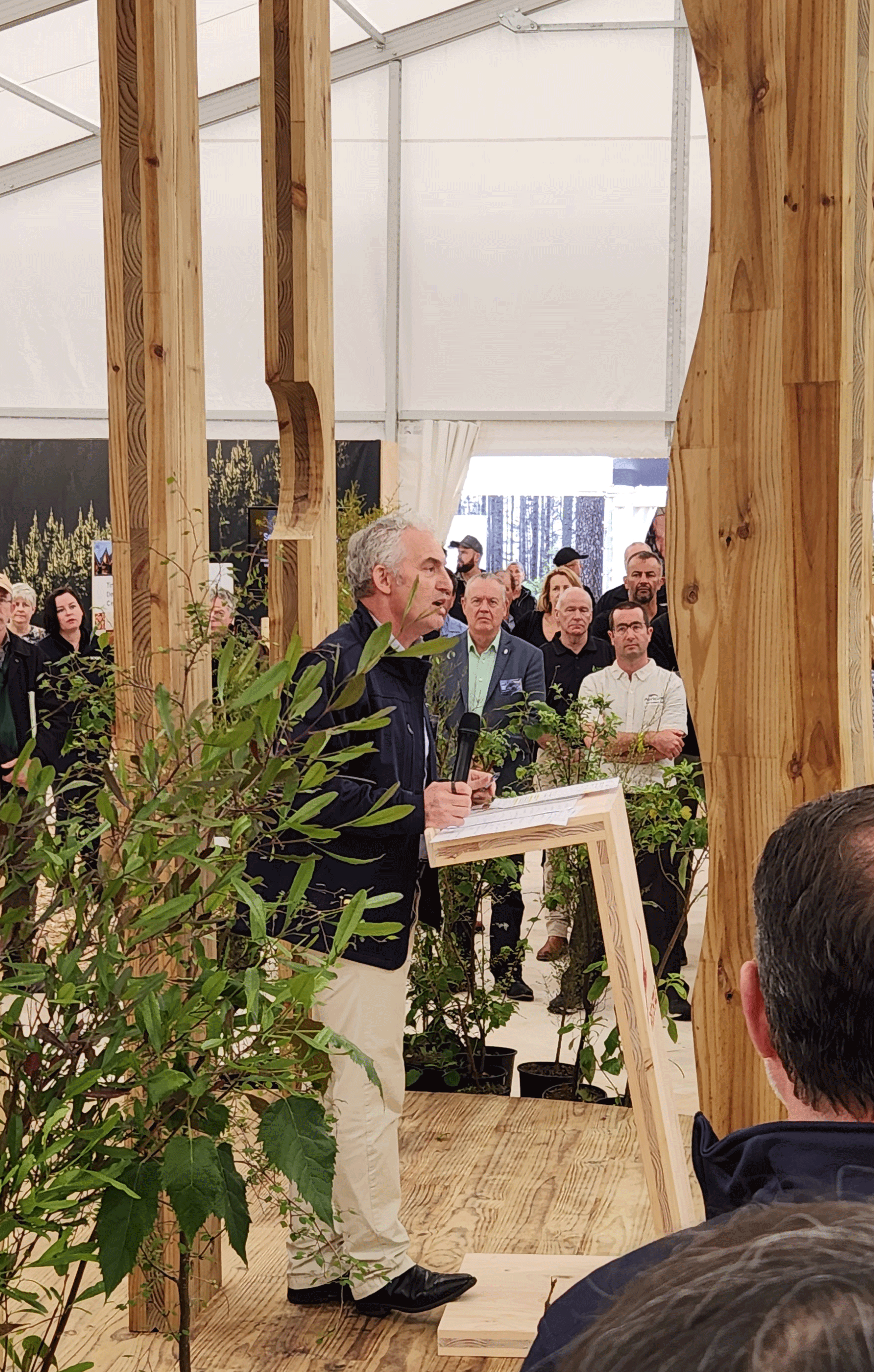

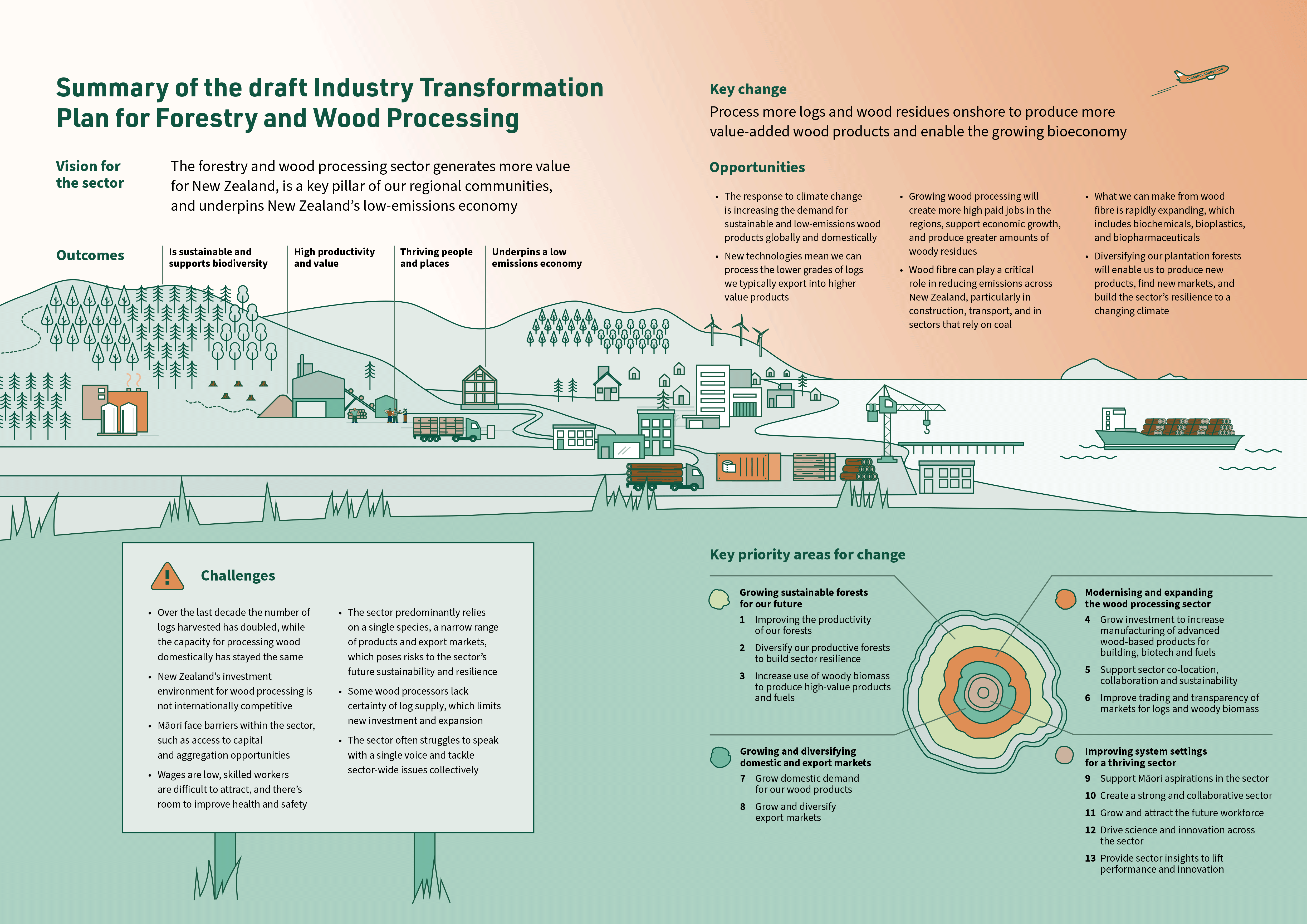

Industry Transformation Plan for Forestry & Wood Processing Sector officially launched at Fieldays

Minister Stuart Nash launched the Forestry and Wood Processing Industry Transformation Plan at Fieldays on 30 November 2022.

The Plan aims to support the sector to make better use of our forestry resources by:

- processing more wood onshore

- producing more high-value wood products, and

- using residues to grow the forest-based bioeconomy.

The Plan’s goals are that, by 2030, the industry will increase:

- Logs processed each year by 25%

- Use of timber in construction each year by 25%

- Export sector returns by an additional $2.6bn

Forest Enterprises made a submission in support of the draft Industry Transformation Plan from the Ministry of Primary Industries.

Radiata pine: The ‘muscle tree’

It’s not uncommon that investors will ask us, “Why pine?”. There are many good reasons, especially in the context of investment returns.

This article – from the latest edition of the Bulletin from the Forest Owners Association – gives a great summary of why pine is a ‘muscle tree’.

Fieldays Forestry Hub a first for our sector

Forest Enterprises took part in the Fieldays Forestry Hub at Mystery Creek this month. This was the first time a Forestry Hub has been launched by the forestry sector at Fieldays, and our first time back in 25 years.

We were one of around 35 timber and forestry organisations which exhibited, together showcasing every aspect of New Zealand’s forestry sector from primary production to new product innovation.

The Hub’s theme was “Wood Our Low-Carbon Future“.

Wood Our Low-Carbon Future is a new campaign to educate Kiwis about the people and innovations driving timber use and production in New Zealand. It stands for sustainable communities, resilient landscapes, and a legacy for future generations.

Funded and delivered by Te Uru Rākau – Forestry New Zealand and the Forest Growers Levy Trust.

Spring 2022 Forestry Bulletin out now

- Forestry ITP

- Pines v. other exotics

- Falcon and kiwi protection

- Railway to Wairoa

- Energy – the new frontier for forestry…

Read the Spring bulletin >>

Free digital copy of Informed Investor

Your Summer 2022 edition, compliments of the Informed Investor team.